A Hong Kong financier has been ordered to cut ties with a junior exploration company hunting for cesium, lithium and other critical minerals near Cochrane.

In the federal government’s first action since last week’s announcement of its clampdown on unfriendly countries investing in Canadian natural resources. Sinomine Rare Metals Resources will have to divest itself of its investment in Power Metals Corp., a Vancouver and Phoenix, AZ-based exploration firm.

The orders come under section 25.4(1) of the toughened up new foreign investment rules in the Investment Canada Act (ICA),

Innovation, Science and Industry Minister Francois-Phillippe Champagne delivered the news on Nov. 2, ordering Sinomine and two other Hong Kong and Chinese companies – Chengze Lithium International and Zangge Mining Investment (Chengdu) – to pull their investments from Vancouver and Calgary-based companies with lithium projects in South America.

"The government's decisions are based on facts and evidence and on the advice of critical minerals subject matter experts, Canada's security and intelligence community, and other government partners,” Champagne said in a statement.

Expect more such announcements in the future, he said.

Power Metals’ 9,500-hectare Case Lake Property is 80 kilometres east of Cochrane and 100 kilometres north of Kirkland Lake, close to the Quebec border. The company has been conducting exploratory drilling there since 2017.

Sinomine jumped aboard as a partner last January following the discovery of cesium on the property. The Chinese financier signed an offtake agreement with Power Metals last March for all the lithium, cesium and tantalum that would be produced from a future mine.

An off-take agreement is an arrangement between a mining company and a buyer. They're generally negotiated after a mine feasibility study is done and before mine construction. The arrangement only works if the exploration project becomes a mine.

But the Case Lake property still remains in the exploration stage and Power Metals has not yet released a mineral resource estimate.

Lithium, cesium and tantalum are on Canada's list of critical minerals considered vital in aerospace, defence, telecommunications, computing, and a number of clean technologies such as solar panels and electric car batteries.

These minerals are key for the Canadian and U.S. governments to transition into a more green economy while securing more safe and secure raw materials for the domestic supply chain.

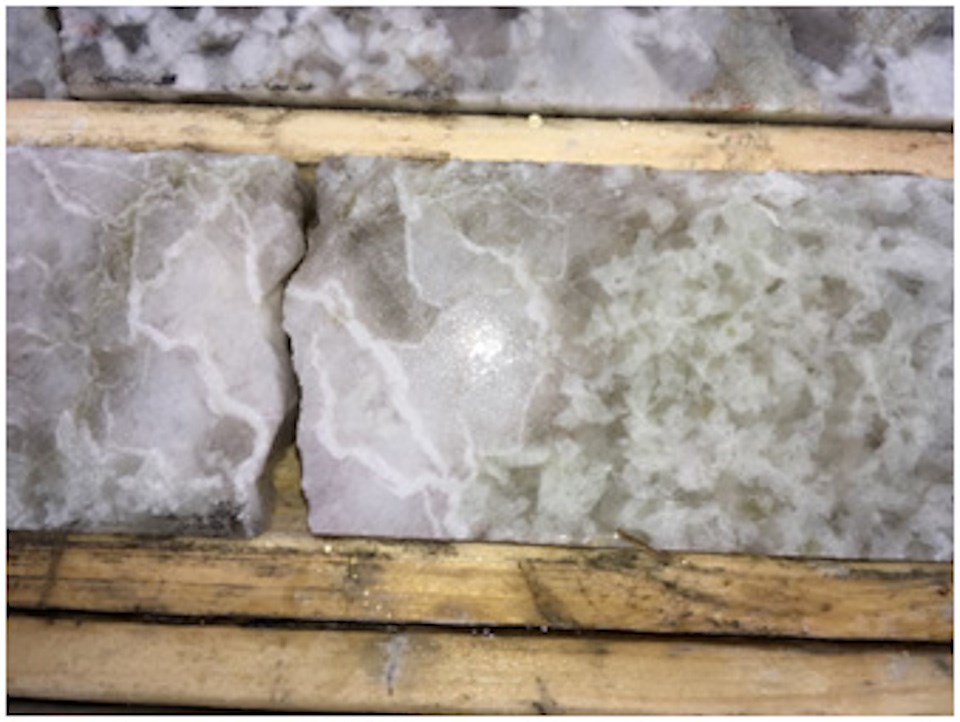

Last summer and into this fall, Power Metals has been releasing a steady news flow of high-grade drill hits of lithium and cesium at Case Lake.

Power Metals first signed a letter of intent with Beijing-based Sinomine Resource Group in Sept. 2020. Sinomine is the owner of the Tanco Mine in eastern Manitoba, one of the world’s largest underground cesium and tantalum mines that’s been in operation since the late 1960s. Sinomine bought it in 2019.

Ottawa made no mention in yesterday’s news release regarding Sinomine’s ownership of that operation.

"The government will continue to work toward an ICA framework that is well calibrated to ensure Canada's continued prosperity and to face evolving national security challenges,” said Champagne.

"The federal government is determined to work with Canadian businesses to attract foreign direct investments from partners that share our interests and values,”