NEWS RELEASE

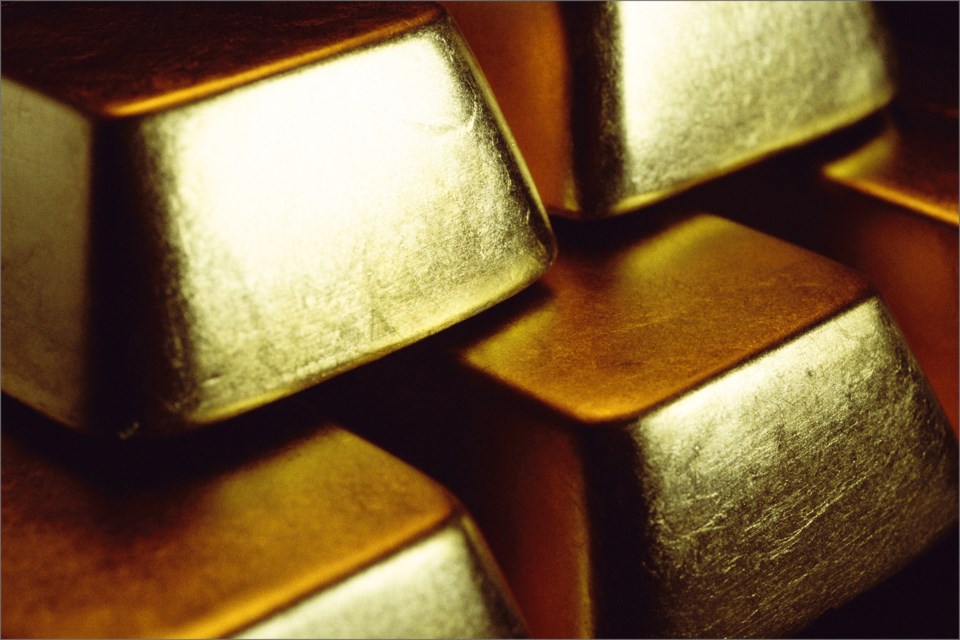

DETOUR GOLD

*************************

TORONTO - Detour Gold Corporation (TSX:DGC) ("Detour Gold" or the "Company") reports its operational and financial results for the second quarter of 2016.

This release should be read in conjunction with the Company's second quarter 2016 Financial Statements and MD&A on the Company's website or on SEDAR. All amounts are in U.S. dollars unless otherwise indicated.

Q2 2016 Highlights

- Gold production of 139,359 ounces

- Total cash costs of $691 per ounce sold and AISC of $1,030 per ounce sold

- Revenues of $166.7 million on gold sales of 131,606 ounces at an average realized price of $1,230 per ounce

- Earnings from mine operations of $34 million

- Net loss of $30.7 million ($0.18 per share) and adjusted net earnings of $3.9 million ($0.02 per share)

- Debt reduction of $82 million ($75 million announced on April 27, 2016)

- Cash and short-term investments balance of $153.7 million at June 30, 2016

- Positive drilling results from Zone 58N

- Production guidance revised from 540,000 to 590,000 ounces to 540,000 to 570,000 ounces of gold and sustaining capital increased by $10 million

"The Company has accelerated its debt reduction program by buying back $82 million of debt from cash flow in the second quarter. We are now in a position to have surplus cash to meet our debt reduction target of $300 million by year-end, well ahead of our original target of late 2017," stated Paul Martin, President and CEO of Detour Gold.

"To better reflect our operational expectations for the second half of 2016, we believed it was appropriate to remove the upper end of our annual production guidance."

Q2 2016 Summary Operational Results

- Gold production totaled 139,359 ounces, in line with the Company's quarterly guidance range, based on mill throughput of 5.3 million tonnes (Mt) at an average grade of 0.92 grams per tonne (g/t) and average recoveries of 89%.

- Recoveries were lower than plan in June mainly as a result of operational issues in the recovery circuit.

- The processing plant averaged a record 58,466 tpd in the second quarter despite a significant planned shutdown in the first half of April to replace the 410-conveyor system. Following its successful installation and commissioning, throughput rates averaged nearly 65,000 tpd in May and June.

- A total of 21.9 Mt (ore and waste) was mined in the second quarter (equivalent to mining rates of 241,000 tpd). With the transfer of a rope shovel (CAT7495) into waste mining at the end of June, mining rates are expected to average between 250,000 and 270,000 tpd for the second half of 2016.

- At the end of the second quarter, run-of-mine stockpiles stood at 6.5 Mt grading 0.62 g/t (approximately 130,000 ounces).

- The Company completed a 100,000 tonnes test from the ROM medium grade stockpile (average grade of approximately 0.60 g/t) in June to enhance the grade by screening the fines (at minus 2"). Preliminary results indicated a 90% improvement in the grade with 28% of the mass, validating prior survey results.

- Total cash costs were $691 per ounce sold for the quarter. All-in sustaining costs of $1,030 per ounce sold were higher than the prior quarter mainly as a result of the timing of capital expenditures and a higher share-based compensation expense due to the significant share price appreciation during the quarter.

- Mining unit costs were slightly lower than the first quarter as a result of more tonnes mined and processing unit costs were slightly higher as a result of the April scheduled shutdown partially offset by more tonnes milled.

Q2 2016 Financial Performance

- Metal sales for the second quarter were $166.7 million. The Company sold 131,606 ounces of gold at an average realized price of $1,230 per ounce, lower than the average price of the LBMA Gold Price Auction of $1,260 per ounce due to the Company's gold hedging program.

- Cost of sales for the second quarter totaled $132.6 million, including $39.2 million of depreciation or $298 per ounce sold.

- Earnings from mine operations for the second quarter totaled $34 million.

- The Company recorded a net loss of $30.7 million ($0.18 per share) in the second quarter. Adjusted net earnings in the second quarter amounted to $3.9 million ($0.02 per share) and excluded non-cash items such as the impact of foreign exchange resulting in a deferred tax recovery and change in the fair value of the Company's convertible notes.

Q2 2016 Liquidity and Capital Resources

- Operating cash flow was $45.8 million for the second quarter.

- During the second quarter, sustaining capital expenditures were $27.6 million, including $18.5 million for the mine (i.e. one additional haul truck and major components on loading equipment), $4.4 million for the plant, $4.0 million for the tailings facility and $0.7 million for others. Deferred stripping costs totaled $1.1 million for the period. Non-sustaining capital expenditures totaled $0.4 million for the second quarter.

- Cash and short term investments totaled $153.7 million at June 30, 2016. The Company's Cdn$85 million revolving credit facility remains fully undrawn.

Financial Risk Management

- As at June 30, 2016, the Company had a total of 65,000 ounces of outstanding gold forward hedge contracts at an average price of $1,190 per ounce to be settled during 2016. In addition, the Company has entered into "zero-cost" collars to hedge a further 40,000 ounces of gold, providing an average floor price of $1,243 per ounce and participation up to an average rate of $1,359 per ounce.

- As at June 30, 2016, the Company had zero-cost collars to hedge a total of $65 million, guaranteeing it will purchase Canadian dollars at a rate of no worse than 1.26 and can participate at a rate of up to 1.34.

2016 Guidance Revisions

- Given the results for the first half of the year and projections for the second half of the year, the Company is narrowing its 2016 gold production guidance to between 540,000 and 570,000 ounces (previously 540,000 to 590,000 ounces). Due to slower mining progress in the area of the Campbell pit in the first half of the year, the Company does not anticipate accessing higher grade ore in that area during the second half of the year, which will negatively impact gold production by 15,000 to 20,000 ounces. The Company plans to start the processing of the medium grade fines (refer to p. 2) in the second half of the year.

- In addition, all-in sustaining costs are now expected to be between $920 and $980 per ounce sold (previously $840 to $940 per ounce sold), mainly as a result of lower production, higher sustaining capital expenditures of approximately $10 million and higher shared-based compensation costs as a result of the increase in the Company's share price from year-end. Approximately $5 million of the increase in sustaining capital expenditures is for the lead nitrate project (for recovery improvements) which was initially planned for 2017. Capitalized stripping estimates remain unchanged at between $5 and $10 million for 2016.

About Detour Gold

Detour Gold is an intermediate gold producer in Canada that holds a 100% interest in the Detour Lake mine, a long life large-scale open pit operation.

Detour Gold Corporation, Commerce Court West, 199 Bay Street, Suite 4100, P.O. Box 121, Toronto, Ontario M5L 1E2

*************************