The City of Greater Sudbury’s claim that its taxes are “among the lowest in the province” has been complicated by a competing, but also factual, report.

This report, by real estate website Zoocasa, has sparked dialogue in the community with its statement that Greater Sudbury had the fifth-highest property tax rate in the province 2021, which echoes their report’s findings in 2020.

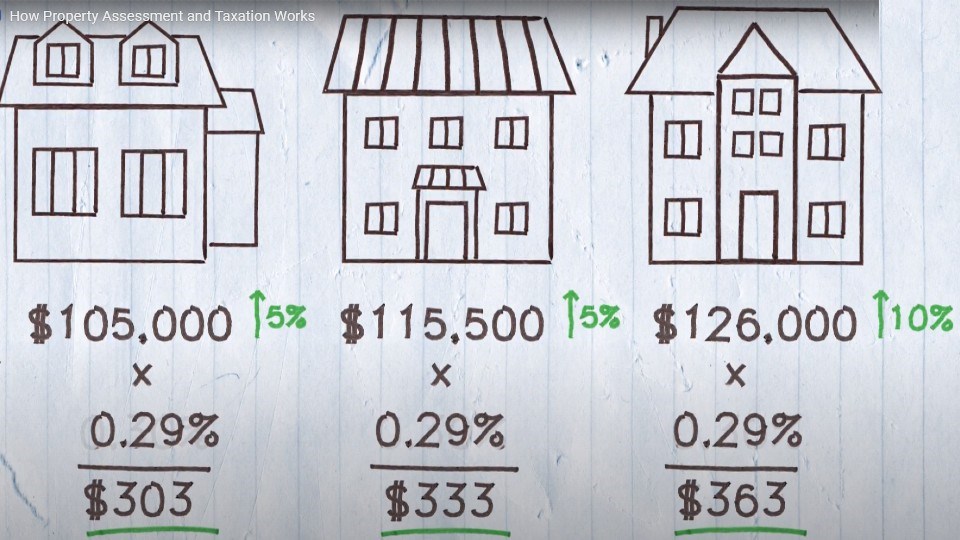

“Zoocasa looks only at tax rates, not property tax amounts,” Ward 7 Coun. Mike Jakubo said, noting that rates work in concert with property assessments to determine how much property owners pay in taxes. Rates alone do not indicate how much is paid.

The BMA Management Consulting Inc. report the city uses in their reporting notes that the actual amounts Greater Sudbury property owners pay are closer to the middle of the road when compared to property owners in municipalities across the province.

The “among the lowest in the province” statement comes from Page 304 of the report, in which it’s noted the taxes paid for a single-family bungalow in Greater Sudbury ranks as the second-lowest among municipalities with populations greater than 100,000.

Although both the Zoocasa and BMA reports are accurate, Jakubo, who also chairs the city’s finance and administration committee, said the BMA report offers a better apples to apples comparison between municipalities.

“Here in Greater Sudbury we have lower assessment values, but our costs to operate the city remain similar to everywhere else in the province,” he said. “So yes, we will have some of the highest rates, but our lower assessment values mean that we do have the second-lowest property taxes for municipalities in Ontario with over 100,000 population.”

An example Zoocasa uses to give their reporting context is that a Toronto homeowner with a property valued at $500,000 would pay $3,055 in property taxes based on the city’s rate of 0.611013, which is the lowest among those listed. A similarly priced home in Windsor, which carries the highest tax rate of 1.818668, would have a tax bill of $9,093.

However, mortgages go a lot further in Windsor than they do in Toronto. The average home price in Windsor is $535,452 while the average home price in Toronto is $1,090,096. Greater Sudbury’s average housing price in 2020 was $356,633.

In Zoocasa’s ranking of 35 municipalities’ tax rates, those with higher-valued real estate tend to do more favourably, with all but one of the top five highest tax rates recorded in Northern Ontario:

- Windsor: 1.818668

- Thunder Bay: 1.59108

- Sault Ste. Marie: 1.588067

- North Bay: 1.568182

- Sudbury: 1.546783

The annual BMA report ranks 110 municipalities by several metrics, and many of its property tax rankings record the amount of taxes paid rather than tax rates. They also use specific properties as constants to compare municipalities.

The detached bungalow constant between municipalities Greater Sudbury has been using to promote its low tax rate and which Jakubo cited is 1,200 square feet in size with three bedrooms, one and a half bathrooms and a garage on a 5,500-square-foot property.

By this metric, and among municipalities with populations greater than 100,000, Greater Sudbury ranks as second-lowest behind Chatham-Kent.

“For Greater Sudbury, what this means is that our city provides a comparable suite of services to the other comparator municipalities and does so while collecting the second-lowest amount of property taxes,” Jakubo said.

“This means that our city provides very high value for service compared to other large cities in Ontario.”

A two-storey home example in the BMA report ranks Greater Sudbury less favourably, with the property receiving a “high” taxes paid ranking among Ontario municipalities in general and a near-average ranking among municipalities with populations greater than 100,000.

Various other property comparisons rank the taxes paid in Greater Sudbury across the board when compared to other municipalities with at least 100,000 people, from the low to high of the scale.

When it comes to net municipal tax levy per capita, Greater Sudbury ranks average among Ontario municipalities regardless of population, with $1,707 paid in Greater Sudbury. The provincial average is $1,661.

The conversation about tax rates is taking place in the wake of city administration releasing a proposed budget on Nov. 2 that includes a 4.7-per-cent tax increase. Greater Sudbury city council is scheduled to engage in budget deliberations from Nov. 29 to Dec. 1.

Tyler Clarke covers city hall and political affairs for Sudbury.com.