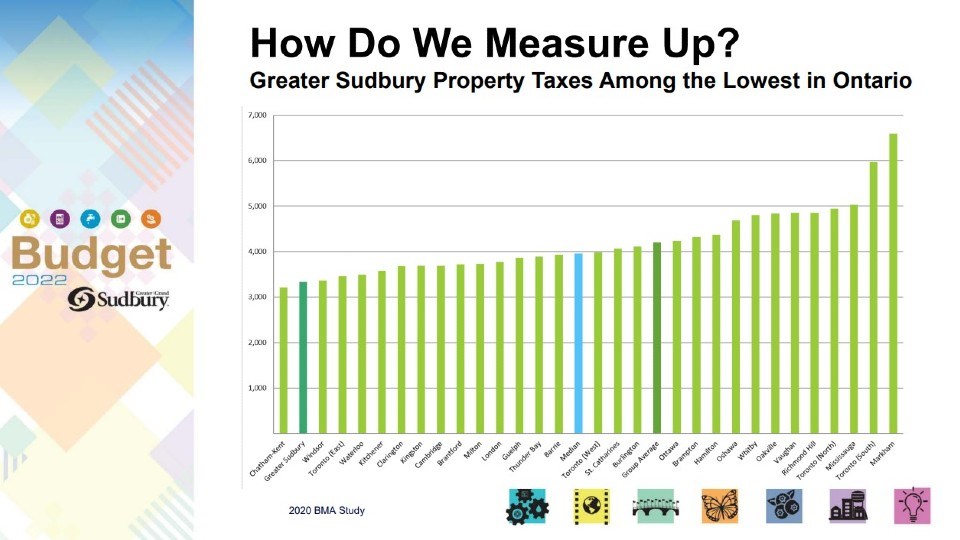

It might not feel like it when the taxman comes knocking, but the City of Greater Sudbury’s property taxes are “among the lowest in Ontario.”

This, according to a bar graph included in a budget presentation city CAO Ed Archer made during Tuesday’s finance and administration committee meeting.

By a much broader metric, Greater Sudbury’s property taxes are much closer to average among Ontario municipalities.

But, it depends on what variables you factor in.

In his budget presentation, Archer focused on the property taxes the owner of a detached bungalow would pay in 30 Ontario municipalities with populations greater than 100,000.

In Greater Sudbury, this property owner would have paid $3,331 in 2020, which was the second-lowest rate behind Chatham-Kent and far shy of the group’s overall average of $4,201.

“We always hear from residents that ‘We pay the most taxes,’ and I’m sure that’s the feeling that we have, but with these numbers, it shows that we are far from that,” Ward 6 Coun. René Lapierre said during Tuesday’s meeting.

Lapierre also tweeted an image of the graph featured during Archer’s presentation, which includes the claim “Greater Sudbury Property Taxes Among the Lowest in Ontario” and lacks context regarding what property type and municipality size has been factored into the graph.

The “detached bungalow” used as an example is a 1,200-square-foot home with three bedrooms, one and a half bathrooms and a garage on a 5,500-square-foot property, city executive director of finance, assets and fleet Ed Stankiewicz told Sudbury.com on Wednesday.

“That’s the property used throughout Ontario to identify each one of these residences in every municipality,” he said, echoing a point of consistency Archer also highlighted during Tuesday’s meeting.

BMA Management Consulting Inc. compiles statistics from municipalities throughout the province, drawing data from financial information returns all municipalities must file in the exact same manner, Archer explained. This is the information that was included in the graph, which features data from Page 304 of BMA’s 2020 report.

“We draw this out because, of course, it’s relevant for the context of our budget deliberations,” Archer said, adding that it demonstrates the city is efficient in its use of taxpayer dollars.

“Greater Sudbury’s taxes are among the lowest in the province for what is essentially a similar basket of services for cities of a similar size.”

Although the owner of the aforementioned detached bungalow would pay lower taxes in Greater Sudbury than in all but one Ontario municipality with a population greater than 100,000, the taxes they pay would be considered in the “mid” range among Ontario municipalities in general.

Within all Ontario municipalities included in the report regardless of population, the detached bungalow owner would have paid an average of $3,549 in property taxes in 2020.

Smaller municipalities would “not provide the same level of services as we do,” Stankiewicz said, explaining why tax rates in more populous municipalities are, on average, greater.

The BMA study that the City of Greater Sudbury drew data from also includes various other measures of taxation in which the city doesn’t perform as well within its own class.

The following is what the average owner of various property types in Greater Sudbury paid in property taxes in 2020 compared to the average among municipalities with populations greater than 100,000:

- Two-storey home: $5,280 (avg. $5,275)

- Multi-residential walk-ups: $1,818 per unit ($1,754)

- Multi-unit residential high-rises per unit: $1,940 ($1,974)

- Office buildings per square foot: $3.61 ($3.69)

- Neighbourhood shopping per square foot: $4.84 (4.93)

- Hotels per suite: $1,724 ($1,634)

- Motels per suite: $1,973 ($1,538)

- Standard industrial per square foot: $3.64 ($2.11)

- Large industrial per square foot: $1.17 ($1.34)

- Industrial vacant land per acre: $6,323 ($9,791)

Among all Ontario municipalities studied regardless of population, Greater Sudbury ranked near the middle as it relates to net municipal tax levy per capita. They recorded a net 2020 levy per capita of $1,707, which is slightly greater than the provincial average of $1,661.

Greater Sudbury city administration proposed a 2022 tax increase of 4.7 per cent on Tuesday, which the city’s elected officials are poised to debate at length later this month.

Tyler Clarke covers city hall and political affairs for Sudbury.com.