A group of companies with 405 residential properties has filed for creditor protection under the Companies’ Creditors Arrangement Act (CCAA) process after finding themselves insolvent.

From legal documents, it appears rising interest rates and companies overextending themselves were to blame.

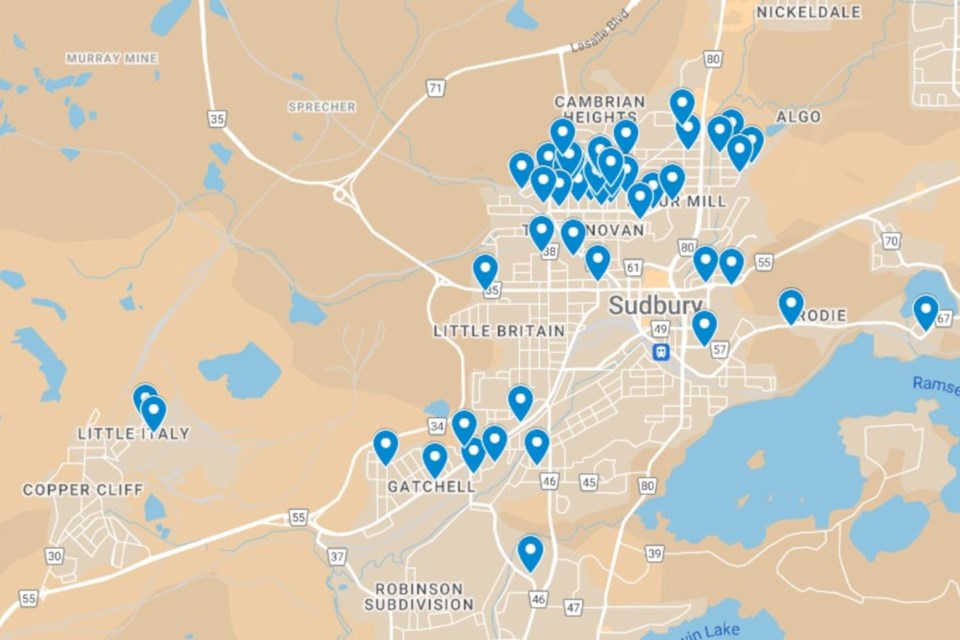

Their 405 residential properties include 51 Greater Sudbury addresses listed in court documents, which also clarify the companies’ Greater Sudbury properties include 78 units.

The companies include Balboa Inc., DSPLN Inc., Happy Gilmore Inc., Interlude Inc., Multiville Inc., The Pink Flamingo Inc., Hometown Housing Inc., The Mulligan Inc., Horses in the Back Inc., Neat Nests Inc. and Joint Captain.

They are all affiliated with SIDRWC Inc., which operates as SID Developments, SID Management Inc. and 2707793 Ontario Inc., which operates as SID Renos.

KSV Restructuring Inc. has been installed as the monitor, whose responsibilities include assisting the companies with their restructuring and reporting to the court.

The CCAA is a federal statute that allows debtor companies to restructure their financial affairs under the supervision of a court, and avoid bankruptcy.

In an affidavit by SIDRWC Inc. president Robert Clark, it’s noted the companies’ “inability to obtain a comprehensive refinancing solution has resulted in the incurrence of substantial losses over the previous 18 months.”

Meanwhile, the companies, which reportedly have less than $100,000 cash on hand, have kept 207 of their 631 units in Ontario vacant “as they do not currently have the funding to renovate them,” according to court documents.

“If the Applicants lease an unrenovated unit, it is subject to provincial rent control legislation and tenants’ rights to continue to occupy the units,” the document notes.

Keeping these unrenovated buildings vacant is costing the companies approximately $350,000 per month in lost rental revenues.

Of their 78 units in Greater Sudbury, 53 are occupied and 25 are empty.

Placed on a map, most of their 51 Greater Sudbury properties are located in the Donovan and Flour Mill neighbourhoods, with a handful also located in the Gatchell neighbourhood, plus a scattering throughout the balance of the city. There are two in Capreol, one in Val Caron and two in Copper Cliff.

The companies owe creditors $147 million, including $363,372 within Greater Sudbury. Of this, $283,704 is owed to the City of Greater Sudbury and $38,618 is owed to Greater Sudbury Utilities.

The main purpose behind CCAA proceedings is “to create a stabilized environment to enable the applicants to preserve and maximize value for their stakeholders and provide the stability and liquidity necessary to complete value-accretive (increasing) renovations to their portfolio of residential homes.”

In 2022, the company divested of 223 residential properties in an attempt to stave off insolvency, as well as receive 121 second mortgages.

The prospect of selling additional properties has come up, but there’s concern it will “result in depressed recoveries for Investors and/or will take several years to complete as a result of current depressed market conditions in the various communities in which the properties are located.”

It’s reported there were 407 active listings and 101 units sold in Sudbury in December, indicating there was already a four-month inventory in the marketplace.

KSV Restructuring Inc. has also considered a controlled sale process in which properties are listed gradually, which would take 27 months to complete in Sudbury.

The companies’ properties have a total appraised value of approximately $173 million. Since the companies started work in 2020, they’ve renovated, leased and/or sold more than 800 properties, including more than 1,200 rental units.

In addition to filing for creditor protection, the companies are also the target of 32 civil lawsuits filed in the Ontario Superior Court of Justice by lenders, according to Sudbury.com sister site SooToday.com.

At the latest update, the CCAA process was ongoing, with a stay period (protection from creditors) extended to Feb. 16.

“It is not possible to provide a specific estimate on timing this early in the CCAA proceedings, but it is likely to take several months for the Companies to implement a restructuring or refinancing transaction,” according to KSV Restructuring Inc.

It’s business as usual in the meantime, and rent will still need to be paid.

Tyler Clarke covers city hall and political affairs for Sudbury.com.